Macro Signposts | 11 June 2024

We noticed that it's been a while since you've read Macro Signposts. If you'd like to continue to receive this weekly communication, please write to [email protected]. Otherwise, you'll no longer receive Macro Signposts, though you can subscribe again anytime.

I would like to thank Libby Cantrill, head of public policy, and Graeme Westwood, economist, for their insights and contributions to this edition.

Unless explicitly stated, views expressed do not constitute official PIMCO views.

Stricter Immigration Policies Likely to Weigh on U.S. Growth

The Biden administration's recent executive order to secure the southern border could have far-reaching economic implications. By slashing annual immigration by potentially over one million people, this policy could trim U.S. GDP by up to half a percentage point this year and heighten the likelihood of the Federal Reserve initiating a series of rate cuts later in 2024.

Issued on June 4, the order aims to cut annual immigration from 3 million people in 2023 to between 1.6 and 2.2 million, based on our analysis of the statement and data from U.S. Customs and Border Protection (CBP). It seeks to achieve this by restricting asylum eligibility for individuals who cross the southern border between ports of entry and tightening the standards for initial asylum screenings.

In our 15 November 2023 Macro Signposts, we suggested that immigration in 2023 may have bolstered U.S. GDP growth by 0.5 to 1.0 percentage points through increased consumption and government spending. The new policy, if implemented, could reduce 2024 GDP growth by 0.3 to 0.5 percentage points, lowering our forecast to 1.5%-1.7% (Q4/Q4).

The implications for U.S. inflation are more ambiguous, as immigration tends to augment both economic demand and supply. For instance, with higher immigration we might observe downward wage pressure in lower-skilled service jobs but upward pressure on rental inflation in some areas. Overall, we believe slower, below-trend real GDP growth from this policy is likely to bolster the Federal Reserve's confidence that inflation is returning to the 2% target, bolstering our view that policy rate cuts will start later this year, despite what has been a stickier U.S. inflation path year to date.

Key provisions of the executive order

The order states that once the number of migrant encounters at the southern border reaches a certain average daily threshold (2,500), the government will take "enhanced actions" to screen for asylum eligibility, which aims to increase the government's ability to quickly process the influx of people. This means fewer people will be allowed to stay within the country while they await interviews and eventual court hearings.

Daily southern border encounters between points of entry so far this year have averaged around 4,400 per day, according to CBP data, so the enhanced action will apply immediately.

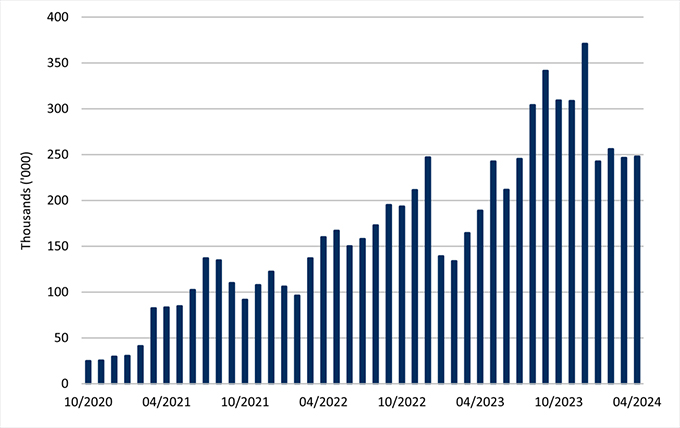

Figure 1: Migrants seeking to enter the U.S., by month

|

Source: U.S. Customs and Border Protection data as of April 2024

Through April of this year, border agents also reported an average of 250,000 people per month seeking to enter the U.S. at and between all U.S. points of entry (see Figure 1). Of that total, the southern border accounted for around 180,000 per month. Many of these immigrants lack legal immigrant status but claim asylum at authorized points of entry, prompting further screenings to assess their asylum claims.

Similarly, individuals who cross the border between ports of entry and are apprehended by an agent can also claim asylum. In the past, these individuals awaited initial asylum screenings in holding centers. However, after the influx of immigrants overwhelmed the system, agents started releasing these individuals into the U.S. to await court hearings, which can take years due to the currently enormous backlog of cases. During this waiting period, migrants are eligible to apply for work permits, and while waiting for these permits, individuals consume goods and services.

Under the new executive order, if agents don't believe immigrants have a strong case, they will face the "expedited removal" process, bypassing the usual "fear screening" interviews completed by government asylum officers. Immigrants can still appeal, but the appeal process goes into an expedited court review within a week. Altogether, the policy would meaningfully reduce the monthly flow of immigrants allowed to stay while awaiting asylum processing and court hearings, and could reduce overall immigration by 25% to 45%.

There are legal and logistical obstacles to implementing the new policy. Human rights advocacy groups may litigate, potentially suspending implementation. There are also current government resource constraints, although there is precedent for large numbers of expedited removals under Title 42, which limited border crossings during the COVID-19 pandemic (this order was subsequently deemed unlawful).

Impact on U.S. growth

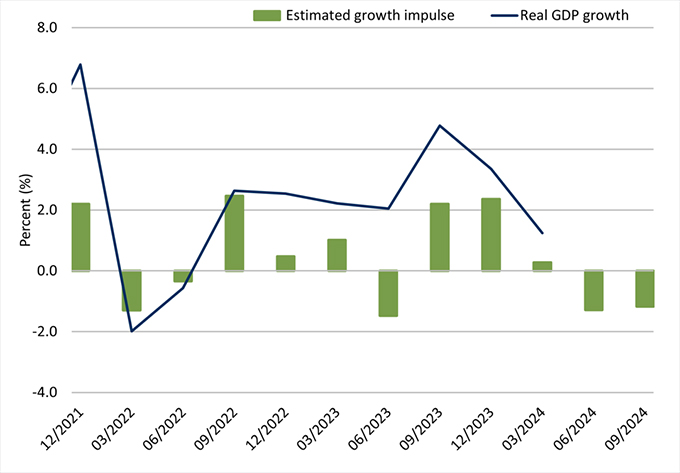

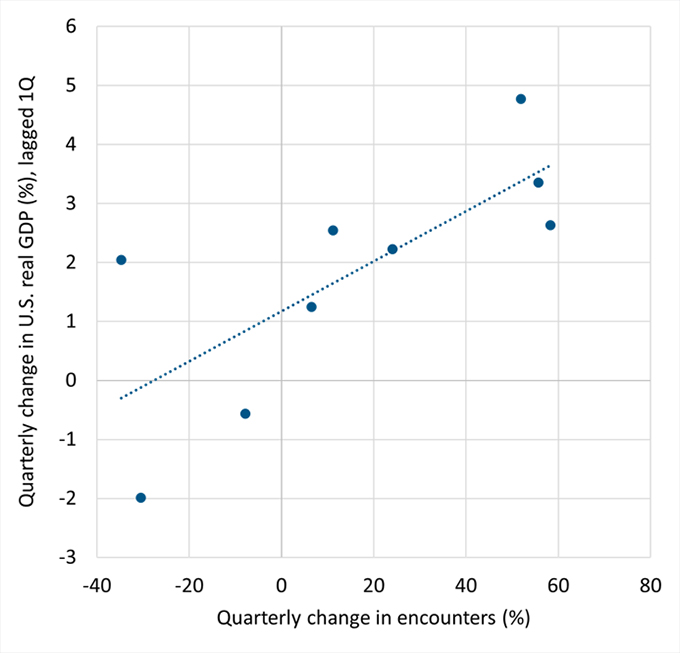

In our 15 November 2023 Macro Signposts, we estimated that the additional immigration may have increased 2023 U.S. GDP growth by 0.5 to 1.0 percentage points (see Figure 2). Our estimate was a simple back-of-the-envelope calculation based on the estimated additional labor supply and potential associated productivity. However, looking at simple correlations between quarterly real GDP growth and the change in border encounters from the end of 2021 through the end of 2023 (see Figure 3) suggests that immigration boosted growth (and specifically both consumption and government spending growth) not only in theory but also in practice.

Figure 2: U.S. real GDP growth and estimated impulse from immigration

|

Source: U.S. Customs and Border Protection, U.S. Bureau of Economic Analysis, PIMCO calculations; data as of 1Q 2024 with estimates through 3Q 2024. Real GDP growth is quarter-over-quarter, seasonally adjusted annual rates.

Figure 3: Real GDP growth measured against percentage growth in immigrants entering U.S.

|

Source: U.S. Customs and Border Protection, U.S. Bureau of Economic Analysis, PIMCO calculations; data from Q4 2021 through Q4 2023. Dotted line indicates trend.

Before this month's executive order, immigration had already been slowing, partly because the Biden administration previously encouraged Mexico to limit border crossings. In our 22 May 2024 Macro Signposts, we said this could slow U.S. real GDP growth from roughly 3% in 2023 to 2% in 2024. Assuming the U.S. has sufficient logistical capacity and it withstands legal challenges, the order could result in an additional drag on U.S. real growth in the second half of this year and into 2025.

Our calculations suggest lower immigration could take 0.3 to 0.5 percentage points off our prior 2024 real GDP growth forecast - reducing it from 2% to 1.5%-1.7% (Q4/Q4). While this might not seem meaningful, it implies sequential quarterly growth could slow to a below-trend 1%-1.5% annualized pace in the second half of this year - a notable slowing from the 4.7% pace in the third quarter of 2023.

Impact on inflation

The executive order's impact on inflation is more complex. For immigration to moderate inflation, broadly speaking, it needs to add more to the supply side of the equation (labor supply, output, or productivity) than to the demand side (consumption of goods and services, including housing). While many immigrants affect both sides, many others are limited to the demand side:

- spouses and children of individuals on work visas

- international students

- asylum seekers without or awaiting work permits

- individuals whose skills don't match current jobs available

The effects are likely to vary across sectors depending on the match between immigrant skills and sectoral labor demand, and the ability for sectoral supply to respond to stronger demand. For example, while there is some evidence that more labor supply eased worker shortages in the leisure services industry, elevated immigration could have driven inflationary pressures in regional rental markets where housing supply could not respond quickly.

Impact on the economy - and the Fed

We think it has been underappreciated just how much the higher level of immigration boosted U.S. real GDP growth last year. As a result, we also think it will be underappreciated how a material reduction in those flows could drag on growth this year, and into 2025.

We believe the U.S. economy is currently growing solidly, and the labor market remains healthy. However, the net effect of immigration policies could push real GDP growth below trend in the second half of 2024. While this might not have a large net impact on inflation, which we expect to remain above the Fed's target, quickly decelerating growth would likely make Fed officials more confident about lowering rates later this year, and continuing with a string of rate cuts next year.

Catch up on recent editions of Macro Signposts:

- Secular Outlook Takeaways: Yield Advantage | 4 June 2024

- Money: High Velocity, Low Supply | 29 May 2024

- Reading Signals: Inflation, Growth, and the Fed | 22 May 2024

- Assessing Japan's Fiscal Situation | 14 May 2024

- Is Opportunistic Disinflation Back? | 7 May 2024

We welcome your questions about the global macro landscape. Don't hesitate to suggest themes or data for us to analyze and discuss: Please email [email protected].

For regular insights on U.S. policy via email, please sign-up here to receive PIMCO Washington Watch from Libby Cantrill, head of public policy.

All investments contain risk and may lose value.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

This material contains the current opinions of the author and such opinions are subject to change without notice. This material is distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. Since PIMCO Europe Ltd services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, via Turati nn. 25/27 (angolo via Cavalieri n. 4), 20121 Milano, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50-52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. According to Art. 56 of Regulation (EU) 565/2017, an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO Europe GMBH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). According to the Swiss Collective Investment Schemes Act of 23 June 2006 ("CISA"), an investment company is entitled to assume that professional clients possess the necessary knowledge and experience to understand the risks associated with the relevant investment services or transactions. Since PIMCO (Schweiz) GmbH services and products are provided exclusively to professional clients, the appropriateness of such is always affirmed. The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (8 Marina View, #30-01, Asia Square Tower 1, Singapore 018960, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. PIMCO Asia Limited is registered as a cross-border discretionary investment manager with the Financial Supervisory Commission of Korea (Registration No. 08-02-307). The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Investment Management (Shanghai) Limited. Office address: Suite 7204, Shanghai Tower, 479 Lujiazui Ring Road, Pudong, Shanghai 200120, China (Unified social credit code: 91310115MA1K41MU72) is registered with Asset Management Association of China as Private Fund Manager (Registration No. P1071502, Type: Other). | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862. This publication has been prepared without taking into account the objectives, financial situation or needs of investors. Before making an investment decision, investors should obtain professional advice and consider whether the information contained herein is appropriate having regard to their objectives, financial situation and needs. To the extent it involves Pacific Investment Management Co LLC (PIMCO LLC) providing financial services to wholesale clients, PIMCO LLC is exempt from the requirement to hold an Australian financial services licence in respect of financial services provided to wholesale clients in Australia. PIMCO LLC is regulated by the Securities and Exchange Commission under US laws, which differ from Australian laws. | PIMCO Japan Ltd, Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association, The Investment Trusts Association, Japan and Type II Financial Instruments Firms Association. All investments contain risk. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Taiwan Limited is an independently operated and managed company. The reference number of business license of the company approved by the competent authority is (112) Jin Guan Tou Gu Xin Zi No. 015. The registered address of the company is 40F., No.68, Sec. 5, Zhongxiao East Rd., Xinyi District, Taipei City 110, Taiwan (R.O.C.), and the telephone number is +886 2 8729-5500. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | Note to Readers in Colombia: This document is provided through the representative office of Pacific Investment Management Company LLC located at Carrera 7 No. 71-52 TB Piso 9, Bogota D.C. (Promoción y oferta de los negocios y servicios del mercado de valores por parte de Pacific Investment Management Company LLC, representada en Colombia.). Note to Readers in Brazil: PIMCO Latin America Administradora de Carteiras Ltda.Av. Brg. Faria Lima, 3477 Itaim Bibi, São Paulo - SP 04538-132 Brazil. Note to Readers in Argentina: This document may be provided through the representative office of PIMCO Global Advisors LLC AVENIDA CORRIENTES, 299, Buenos Aires, Argentina. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO.

CMR2024-0611-3638125